Research by Binance: Major Crypto Trends until May, 2024

MAY 19,2024

BY NR.BALOCH

Principal Learnings

- This blog post provides an overview of the most important findings in the cryptocurrency markets during the previous month, as reported by Binance Research.

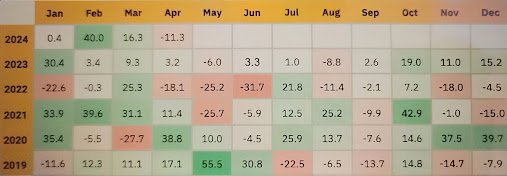

- April was a difficult month for cryptocurrencies, as the pace from earlier months stalled and the total market capitalization fell by 11.3%.

- The DeFi and NFT markets also saw declines, with TVL declining by 0.7% and monthly trading volume falling by 21%, respectively.

This blog post examines significant Web3 developments in April 2024 to give a general picture of the ecosystem’s present situation. Before giving a sneak peek at the key May 2024 events to watch out for, we examine the performance of the cryptocurrency, DeFi, and NFT markets.

Performance of the Crypto Market in April 2024

Cryptocurrency had a challenging month in April, with the overall market value falling 11.3% as the upward momentum from earlier months reversed. This reversal was mostly caused by a slowing in spot bitcoin ETF flows, shifts in rate-cut expectations, and geopolitical uncertainties.

However, there were also encouraging advancements over the month. On April 30, six distinct spot crypto-based exchange-traded funds (ETFs) started trading in Hong Kong following regulatory clearance. Furthermore, the total amount of stablecoins tied to the US dollar hit its greatest level in the previous two years. The steady increase in USDT and USDC stablecoin supplies suggests that the cryptocurrency market is receiving steady inflows of cash.

Crypto market capitalization change on a monthly basis (%)

CoinMarketCap (April 30, 2024) is the source.

Monthly market capitalization-based price performance of the top ten cryptocurrencies

The majority of the 10 most valuable coins at the end of the month had negative market capitalization. Relative resilience was demonstrated by TON and BNB, which saw gains of 1.0% and a minor decline of 1.4%, respectively. The reason for TON’s outstanding growth is the momentum its ecosystem has been experiencing lately. In April, the network’s total value locked (TVL) and monthly active addresses reached all-time highs. For the previous few months, BNB has remained among the best performers.

In April, ETH and BTC both experienced 8% decreases. Still, Hong Kong’s acceptance of three spot BTC and three spot ETH ETFs was a significant step forward for the two top cryptocurrencies. Greater price drops were seen in XRP and SHIB, which had monthly drops of 17.1% and 19.2%, respectively. Among the top four, DOGE, ADA, SOL, and AVAX showed the worst results, declining by over 30% at the conclusion of the month.

Financial decentralization (DeFi)

April was a quiet month for the DeFi sector, which experienced a 0.7% decline in TVL, in line with general market trends. With a monthly gain of 1000% and a TVL above $1 billion, Merlin Chain—a native Bitcoin layer-2 solution—grew at the fastest rate among the top ten chains. Pendle and Hyperliquid were two of the better achievers in terms of protocols. Pendle’s total trading volume surpassed $15 billion, and its TVL hit $5 billion. TVL for Hyperliquid surpassed $435 million, outpacing that of Near, Aptos, and Cardano.

TVL portion of leading blockchains

DeFiLlama (April 30, 2024) is the source

Future Happenings

Binance Research

Volume of monthly NFT trading

CryptoSlam (April 30, 2024) is the source.

In April, the NFT market saw a 21% monthly drop in overall sales volume, amounting to $1.11 billion. With four of the top five collections by sales volume for the month being Bitcoin-based, Bitcoin collections continued to take center stage. The combined sales volume of these collections—Organals, PUPS, WZRD, and NodeMonkes—was $423 million. Reactions to Ethereum collections were still largely negative.

Bitcoin topped the list with $567 million in NFT sales volumes across the main chains, followed by Ethereum with $241 million and Solana with $153 million. In percentage terms, the entire volume of Bitcoin decreased by 5%, while the substantial losses in Ethereum and Solana were close to or greater than 50%. These figures indicate a recent shift in collectors’ attention toward Bitcoin-based offerings.

Future Happenings

The Binance Research team has compiled a list of noteworthy events and token unlocks for the upcoming month to help users remain up to date on the most recent Web3 news. Watch these impending blockchain-related developments closely.

Events to remember in May 2024

Binance Research is the source.

The biggest token unlocks in US dollars

Source: Binance Research’s Token Unlocks

Binance Research

The goal of the Binance Research team is to provide thorough, unbiased, and impartial evaluations of the cryptocurrency market. We provide intelligent perspectives on Web3 subjects, such as the cryptocurrency landscape, blockchain applications, and the most recent advancements in the field.This article is merely a preview of the complete report, which includes in-depth examinations of the most significant market charts from the previous month. It also delves more into the most recent changes pertaining to the TON ecosystem, liquid staking, stablecoin supply, and the Runes protocol.